The Complete Guide to Emergency Funds: Why You Need One and How to Build It

Introduction

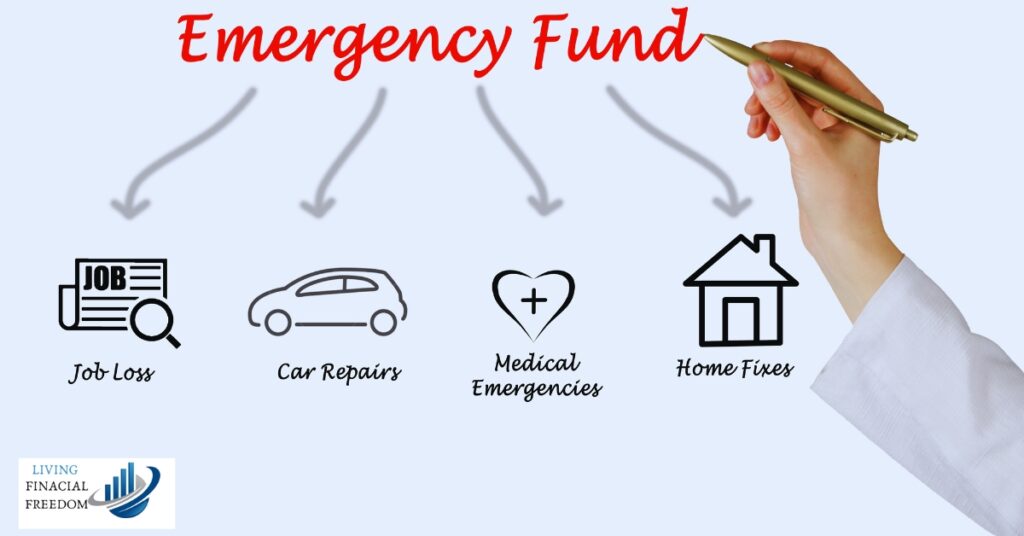

In the journey toward financial freedom, having an emergency fund is non-negotiable. An emergency funds acts as a financial buffer that protects you from life’s unexpected challenges, whether it’s a medical emergency, sudden job loss, or unexpected home repairs. This guide will walk you through the steps to build a robust emergency fund, ensuring you’re prepared for whatever life throws your way.

Understanding the Importance of an Emergency Fund

An emergency fund is a savings account dedicated to covering unplanned expenses. It’s your first line of defense against financial instability and debt. Without it, even a minor financial hiccup can derail your financial goals and force you into debt.

Step 1: Determine the Right Size for Your Emergency Fund

The size of your emergency fund should be tailored to your personal situation. Financial experts generally recommend saving enough to cover 3 to 6 months of living expenses, but this can vary based on factors such as job stability, income, and lifestyle.

- Calculate Essential Expenses: Start by listing your essential monthly expenses, such as rent/mortgage, utilities, groceries, insurance, and minimum debt payments.

- Consider Your Job Security: If you have a stable job, 3 months’ worth of expenses might suffice. However, if your income is variable or your job is less secure, aim for 6 to 12 months.

Step 2: Set a Savings Goal and Start Small

Once you know how much you need, it’s time to set a realistic savings goal. Starting small is key—don’t get overwhelmed by the total amount you need to save. Begin by setting aside a small percentage of your income each month and gradually increase this amount as your financial situation improves.

- Automate Your Savings: Set up automatic transfers to your emergency fund account each payday. This ensures consistent saving without the temptation to spend the money elsewhere.

- Use Windfalls Wisely: Whenever you receive unexpected money, such as tax refunds, bonuses, or gifts, consider putting a portion (or all) of it toward your emergency fund.

Step 3: Choose the Right Account for Your Emergency Fund

Where you keep your emergency fund matters. You want it to be accessible but also earning some interest. A high-yield savings account is often the best choice as it offers a higher interest rate than traditional savings accounts while still providing easy access to your money.

- High-Yield Savings Accounts: These accounts offer higher interest rates, allowing your savings to grow faster without risking your principal.

- Money Market Accounts: Another option to consider, money market accounts typically offer higher interest rates than regular savings accounts and may come with check-writing privileges for easy access.

Step 4: Replenish After Using Your Emergency Fund

If you dip into your emergency funds, it’s crucial to replenish it as soon as possible. The goal is to ensure that your financial safety net is always intact and ready for any future emergencies.

- Set Up a Replenishment Plan: Just as you saved to build your fund, establish a plan to rebuild it after using it. This might involve temporarily cutting back on non-essential spending or redirecting extra income towards replenishing your fund.

- Review and Adjust: As your life circumstances change, review and adjust the amount in your emergency fund to ensure it remains adequate.

Step 5: Avoid Common Mistakes with Your Emergency Fund

Building emergency funds is critical, but it’s just as important to avoid common pitfalls that can undermine your efforts.

- Don’t Tap into It for Non-Emergencies: It can be tempting to use your emergency fund for non-essentials, but this defeats the purpose of having it. Keep it strictly for true emergencies.

- Avoid Keeping It Too Accessible: While accessibility is important, having it too easily accessible might lead to impulsive spending. Choose an account that requires a transfer or trip to the bank to access, adding a layer of protection against impulse withdrawals.

Conclusion

Building and maintaining an emergency fund is essential for financial security and peace of mind. By understanding the importance of an emergency fund, setting realistic goals, choosing the right account, and avoiding common mistakes, you can create a robust financial safety net that prepares you for life’s unexpected events.